Sustainable Financial Solutions and Empowering Diverse Sector

This chapter delves into the diverse facets of Union Bank of India’s commitment to fostering financial prosperity and accessibility. Our 2022-23 fiscal year saw robust growth in key sectors - retail loans, corporate lending, agricultural and MSME advances, underpinned by our dedication to sustainability and digitisation. Surpassing statutory targets and extending credit facilities to underrepresented segments testify to our focus on financial inclusion. This chapter further demonstrates our tailored approach to catalyse economic growth and enhance the financial well-being of our customers, thereby reinforcing our annual theme of steadfast commitment to sustainability, propelled by digital ingenuity.

Retail Loans

In line with Union Bank of India’s commitment to enhancing our clients’ financial health, our retail loan portfolio continues to see an encouraging upward trajectory, consistently contributing to sustainable economic growth and wellbeing for our customers.

During the fiscal year 2022-23, we witnessed an overall year-on-year growth of 17.19% in our retail loans outstanding. This substantial growth signifies not only our sustained efforts to make banking and financial services more accessible to a broader segment of the population but also resonates with our theme of the annual report - “Committed to Sustainability, Driven by Digital Prowess”.

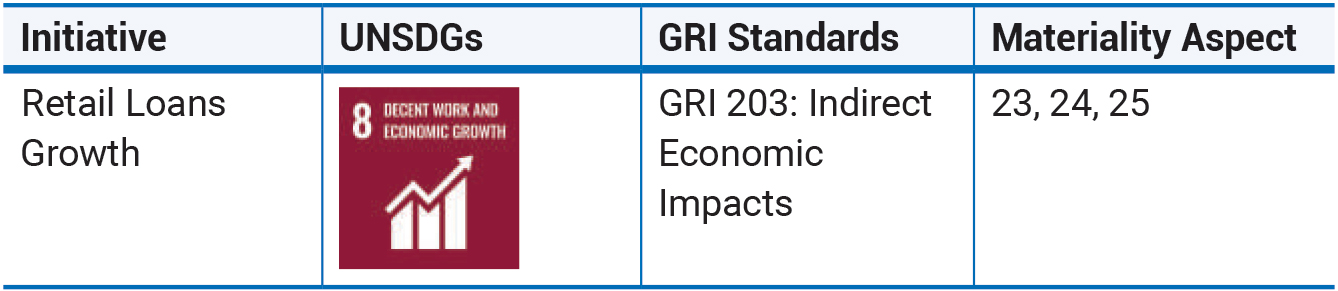

The following table provides a breakdown of the year-on-year growth under retail lending:

By embodying a proactive, customer-centric approach, Union Bank of India stands firm in its resolve to empower customers, catalyse prosperous futures, and stimulate economic growth. Our retail loan segment continues to make strides towards a resilient financial ecosystem that is accessible, inclusive, and beneficial for all.

This growth reflects our persistent efforts in providing diversified, customer-centric financial solutions that cater to the varying needs of our clientele, from home and education to personal and mortgage loans. It is worth highlighting the remarkable growth in personal loans, where we have seen a substantial rise of 91.54% year-on-year and an overall retail growth of ₹ 23,429 crore over March 2022. To augment our impact, we have sanctioned retail loans worth ₹ 32,375 crore PAN India during the fiscal year 2022-23 through Retail Loan Points (RLP). These numbers not only indicate the robust financial health of your Bank but also validate our strategic priorities and approach towards a customer-focused service model.

As a forward-thinking institution, we have also embarked on a series of new initiatives to improve our services’ efficiency and reach. These include the introduction of specialised schemes for education loans, earmarking dedicated education loan officers, launching the Union Suraksha Personal loan, digitalisation of education, and vehicle loan journeys, among others.

The strategic road ahead for us is based on maximising business and market share in identified aspirational districts, streamlining the Retail Loan Point (RLP) structure to improve credit underwriting, forming special cells to cultivate future customer base and HNIs, and continuing to leverage digital capabilities for enhanced service delivery.

Enterprises

Empowering enterprises with sustainable growth, your Bank continues to innovate, digitalise, and champion environmental responsibility, contributing to a robust, resilient economy.

During FY 2022-23, your Bank launched various initiatives to enhance the sustainability and digitalisation of its enterprise services:

- Digital Loan Application Platform: A new digital pre-approved personal loan platform was launched through VYOM, enabling enterprises to apply online loans, reducing the need for paper-based applications. This initiative expedites the loan approval process and contributes to our commitment to environmental sustainability by reducing paper usage.

- Green Financing: To drive sustainable business practices, your Bank introduced favourable terms for enterprises that invest in eco-friendly projects or adopt green technologies. This initiative helps promote sustainable development and mitigate the adverse effects of climate change.

- Fintech Partnerships: Your Bank has actively collaborated with various fintech companies to offer advanced digital solutions to enterprise customers, like instant loan approval, digital payment solutions, and online account management.

- Digitisation of Enterprise Services: To enhance customer experience, we’ve digitised several services, such as account opening, funds transfer, and invoice discounting, among others. Now, enterprises can avail of these services 24x7 from the comfort of their office, reducing the time and cost of banking transactions.

- Cybersecurity Initiatives: In the digital age, data security is paramount. We have invested in robust cybersecurity measures to ensure our enterprise customers can securely conduct their banking transactions.

- Training and Development: We’ve conducted multiple workshops and training sessions to keep our enterprise clients up-to-date with the latest digital banking tools. These sessions ensure that enterprises can leverage the full potential of our digital banking services.

As we step into FY 2023-24, we aim to continue leveraging technology to drive growth and sustainability in the enterprise segment. Our key strategies include expanding our green financing portfolio, introducing more digital services tailored for enterprises, strengthening our cybersecurity framework, and increasing our collaborations with fintech companies to provide innovative banking solutions.

We also plan to conduct more training sessions for our enterprise customers, ensuring they are well-equipped to utilise the benefits of digital banking.

By harnessing the power of digitalisation and promoting sustainable business practices, we aim to drive enterprises’ growth and contribute to our economy’s sustainable development.

Agriculture

Union Bank of India continues to prioritise agricultural lending, recognising its crucial role in fostering economic development and reducing rural poverty. As of March 31, 2023, our agrarian advances constituted 17.77% of the Gross advances, demonstrating our unwavering commitment to this vital sector.

We are proud to announce that we surpassed the statutory agriculture priority target of 18% by achieving a performance rate of 18.97% as of March 31, 2023. In addition, we successfully sold a surplus of ₹ 15,450 Cr under PSLC-Small & Marginal Farmer, underscoring our efficient management and contribution to the sector.

Nurturing agricultural prosperity, we consistently exceed statutory targets, bolster financial wellness in farming communities, and drive economic development through responsible lending.

During the fiscal year 2022-23, we witnessed a robust year-on-year growth of 14.20% in agricultural lending, reaching an outstanding total of ₹ 151,993 Cr as of March 31, 2023.

We also remained steadfast in our commitment to small and marginal farmers, with an outstanding credit of ₹ 95,171 Cr as of March 31, 2023, representing 13.33 percent of ANBC and surpassing the benchmark of 9.50 percent. During the same period, we issued 4.11 lakh fresh Kisan Credit Cards amounting to ₹ 6896.45 Cr.

These milestones reflect Union Bank of India’s continuous efforts in fostering financial wellness among agricultural communities, aligning with our strategic priority of enhancing our clients’ financial health and catalysing prosperous futures.

Micro, Small & Medium Enterprises (MSME)

The Micro, Small, and Medium Enterprises (MSMEs) play an integral role in any country’s economic growth and development. During FY 2022-23, we witnessed a notable increase of 13.06% in our total MSME advances, expanding from ₹ 110577 crore to ₹ 125022 crore.

We have diligently worked on enhancing our services under identified MSME schemes such as Union MSME Suvidha, Union Nari Shakti, Union Equipment Finance, Union Ayushman Plus, and Union Solar, witnessing substantial credit sanctioning across these schemes. The MSME Loan Points, responsible for the appraisal and sanctioning of credit proposals, recorded a sanction of ₹ 35,598 crore during the year.

Our ‘Branch Manager Delegation Power Campaign’ resulted in sanctioning 166,234 loan accounts, bringing in a credit value of ₹ 4,461 crore. Such proactive initiatives were complemented by consistent monitoring by Central Office executives, which significantly boosted the growth of MSME businesses.

Fuelling the entrepreneurial spirit and embracing digital transformation, we ensure robust growth in MSMEs, fostering economic resilience and championing environmental sustainability.

To further fortify our dedication towards MSMEs, we launched 80 additional Union MSME First Branch (UMFBs), raising the total to 105 branches, and managing an MSME portfolio of ₹ 9,000 crore. Additionally, a start-up-focused branch is set to launch in Bangalore. We also noticed a robust increase in utilisation under our approved cluster schemes, skyrocketing from ₹ 2,191 crore to ₹ 10,113 crore.

Our attention to service digitalisation led to the creation of the ‘Centralised Guarantee Cell’ and the ‘Credit Guarantee Management Solutions (CGMS)’ portal, streamlining the processes related to credit guarantees. This initiative enabled us to become the industry’s first bank to have API integration of CGTMSE for fresh guaranteed coverage.

Education plays a critical role in sustaining growth. Consequently, we equipped our Marketing Officers and MLP Heads with intensive orientation and training on credit appraisal and marketing. This endeavour provided them with the necessary skills and knowledge, contributing to better job implementation.

We extended our commitment towards societal growth through active participation in schemes like PMEGP, PMMY, and PMSVANidhi. Through these initiatives, we have helped numerous individuals embark on their entrepreneurship journey, underscoring our dedication towards fostering economic growth.

Understanding the significance of ESG initiatives, we launched digital banking solutions for MSME customers to apply for loans digitally. Products like Straight through Processing (STP) Kishore and Tarun Mudra Loans, Union Nari Shakti, and GST Gain are now available digitally, enhancing the ease of access and usage.

Lastly, we launched the ‘Union Solar’ product to finance borrowers for installing Solar Power Plants. This move aligns with our dedication towards promoting the use of non-conventional energy sources, thereby contributing to environmental sustainability

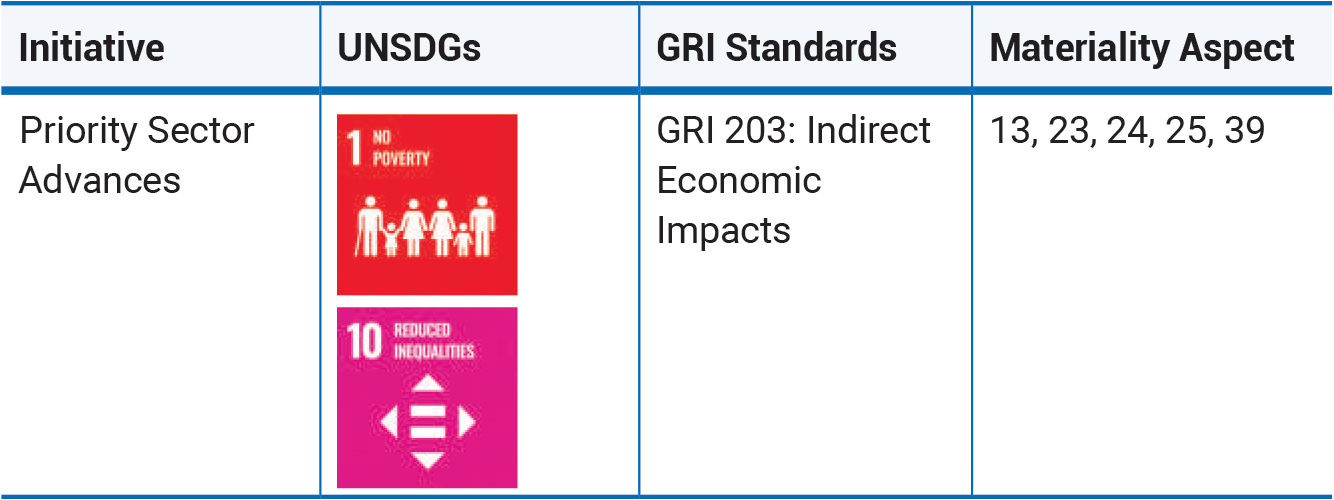

Priority Sectors

Union Bank of India remains committed to serving the diverse needs of society, with priority sector advances reaching ₹ 302,006 Cr as of March 31, 2023. We exceeded the statutory target of 40% by achieving 42.31% of the Adjusted Net Bank Credit (ANBC) for Q1 2023, after excluding PSLC sales and including investments in RIDF/SIDBI/MUDRA/NHB.

Embracing technology and societal commitment, we strive to empower women, minority communities, and weaker sections, driving financial inclusion and fuelling sustainable growth for all.

Our focus on social upliftment has led us to extend credit facilities to weaker and underserved sections, such as women, minority communities, and self-help groups.

- Women Beneficiaries: Encouraging women entrepreneurs, we grew our loans to women from ₹ 89,110 Cr in March 2022 to ₹ 105,954 Cr in March 2023, an 18.90% increase.

- Minority Communities: We offered credit to minority communities, reaching ₹ 28,314 Cr as of March 31, 2023, comprising 9.38% of priority sector advances.

- Weaker Sections: We increased our finances to weaker sections from ₹ 104,698 Cr to ₹ 118,631 Cr as of March 31, 2023, a 13.30% increase.

Our initiatives, like Rural Self Employment Training Institute (RSETI) and Regional Rural Banks (RRBs) like Chaitanya Godavari Grameen Bank (CGGB), further underscore our commitment to rural development. As of March 2023, 308,494 candidates were trained at RSETIs, with 205,525 successfully employed.

Our alignment with government initiatives like Pradhan Mantri Fasal Bima Yojana (PMFBY), Atmanirbhar Bharat Schemes, and renewable energy schemes, coupled with digital initiatives like the Digitization of Kisan Credit Card, further illustrates our determination to leverage technology for financial inclusion and sustainability.

Financial Inclusion Participation for FY2023

In line with our commitment to sustainable development and embracing the digital age, we have prioritised financial inclusion as a key strategic focus for the past fiscal year 2022-2023.

Our progress is evident through the significant growth in Pradhan Mantri Jan-Dhan Yojana (PMJDY) accounts from 244.78 lakhs to 280.00 lakhs, as well as an increase in the associated account balances from ₹ 7780 crores to ₹ 9046 crores. This illustrates our commitment to ensuring that even the most marginalised segments of society are financially empowered.

Moreover, our efforts to integrate Aadhaar, a unique identification system, into our financial inclusion strategies have paid off, with the number of Aadhaar-seeded accounts growing from 204 lakhs to 229 lakhs. Similarly, we also saw a substantial increase in the issuance of RuPay cards, further facilitating digital transactions for our customers.

We are also proud of the significant strides made in terms of our Bank Correspondents (BC) infrastructure, with the number increasing from 16,948 to 17,662. Our BCs play a crucial role in providing banking services in remote areas, and we have targeted to further improve this number to 20,000 in the next fiscal year.

“Leveraging digital technology, we aim to break down barriers to financial empowerment, reaching the most marginalised sections of society and making financial inclusion a reality for all.”

In FY 2022-23, we introduced a new initiative – the enrolment of the New Pension Scheme (NPS) at BC points. This development has allowed us to expand our financial inclusion efforts and make retirement savings accessible to individuals in far-reaching corners of the country.

Additionally, we have leveraged digital technology to improve the monitoring and effectiveness of our BCs through the launch of the BC Monitoring Mobile App. This app streamlines BC operations, serves as a preventive vigilance measure, and provides early warning signals of irregularities at BC points.

For the upcoming fiscal year 2023-24, we are committed to linking BCs at the Jan Samarth Portal and the ZOHO CRM application for lead generation of asset and liability products. Furthermore, we will aim for real-time account opening of PMJDY and real-time APY, PMJJBY, and PMSBY enrolment.