Banking Industry Structure

The Indian banking sector is broadly categorized into scheduled and non-scheduled banks. The scheduled banks are further divided into commercial banks and cooperative banks. Commercial banks comprise public sector banks (PSBs), private sector banks, foreign banks, and Small Finance Banks. Cooperative banks include urban and rural cooperatives.

Union Bank of India (UBI) is a major Public Sector Bank in India. It was nationalized in 1969 by the Indian government and has played a significant role in expanding your Banking sector in rural and semi-urban areas. Union Bank of India is one of the largest government-owned banks in India. Following a merger in 2020, Andhra Bank and Corporation Bank were amalgamated into Union Bank of India, further augmenting its position in the public sector banking space. UBI provides a comprehensive suite of banking products and services, ranging from regular savings and checking accounts to more complex offerings like loans, insurance, and investment services. Its presence is not just limited to urban areas but extends to many rural areas, thus playing a crucial role in supporting rural development and promoting financial inclusion.

Banking Industry Dynamics

FY 2022-23 marked a period of significant transformation and resilience for the Indian banking industry. The sector demonstrated commendable adaptability in the face of the Monetary Policy Committee’s policy shifts and challenging global financial conditions. The year saw your Banking industry weather these changes with robust credit growth across all major sectors, moderate non-performing loans, and improved asset quality. Additionally, despite the increase in the policy repo rate, your Banking industry managed to maintain robust deposit growth while effectively transmitting the changes to retail and bulk deposit rates. These trends suggest a healthy banking sector, capable of supporting India’s economic recovery and growth and poised for further progress in the upcoming fiscal years.

Union Bank of India remains steady amidst global financial changes, contributing to India’s economic recovery. Our stable credit growth and improved asset quality attest to our adaptability in an ever-evolving banking industry.

RBI’s Monetary Policy Shifts in 2022-23: During FY 2022-23, the Monetary Policy Committee (MPC) adopted an aggressive approach towards tackling inflation and supporting growth. It increased the policy repo rate by 250 basis points from May 2022 to February 2023. This strategy aimed to align inflation with the set target, providing a stable economic environment for growth.

Money Market Responses and Repo Rate Transmissions: In the latter half of the fiscal year, money market rates for various maturities followed the rise in the policy repo rate, reflecting the prevailing surplus liquidity. The impact of this development was clear in the weighted average call money rate (WACR), which came into alignment with the repo rate. Furthermore, the pace of policy repo rate transmission to banks’ lending and deposit rates amplified, thanks to the external benchmark regime for loans, the easing surplus liquidity in your Banking system, and the persistence of credit growth over deposit growth.

Resilience in Hostile Global Financial Environment: In the face of a challenging global financial environment in the first half of FY 2022-23, the Indian banking system demonstrated resilience. It maintained adequate capital buffers and moderate levels of non-performing loans. Banks managed to improve their profitability through higher net interest income as the impact of rising interest rates on investment portfolios remained limited.

Acceleration of Bank Credit Growth: In response to improving economic activity, bank credit growth showed an acceleration, especially in the non-food sector. Scheduled Commercial banks (SCBs) registered a year-on-year increase in non-food credit growth of 16.7% as of September 2022, up from 9.7% at the end of March 2022. This robust credit growth persisted into the second half of the fiscal year, driven by resurgent demand in the economy

Sector-Wise Credit Expansion: In FY 2022-23, an improvement in bank credit was noticeable across all major sectors. The agriculture sector experienced credit growth, mainly due to favourable monsoon conditions and an increased target for agricultural credit. The industrial sector also saw a recovery in credit growth, thanks to contributions from both large industries and the MSME segment. Retail loans continued to be a significant driver of credit growth for the year.

Deposits Growth and Asset Quality Improvement: Scheduled Commercial Banks (SCBs) saw their aggregate deposits grow faster in FY 2022-23, spurred by a considerable increase in interest rates. However, this deposit growth lagged behind credit growth for the year. In terms of asset quality, SCBs marked a substantial improvement with a decline in the overall non-performing assets (NPA) ratio.

Banks’ Lending and Deposit Rates Adjustment: In response to the increases in the policy repo rate from May 2022, banks’ deposit and lending rates also increased during the first half of 2022-23. The efforts to raise retail deposits to fund robust credit growth led to a notable transmission to retail deposit rates, especially in the year’s second half.

Shifts in the Weighted Average Domestic Term Deposit Rate: The Weighted Average Domestic Term Deposit Rate (WADTDR) on fresh deposits (including retail and bulk) showed an increase of 222 bps from May 2022 to February 2023. Initially, banks concentrated on mobilising bulk deposits, but the focus shifted towards raising fresh retail deposit rates in the latter half of the year. This shift resulted in the overall growth of term deposit rates, highlighting the increasing demand for durable funds from depositors.

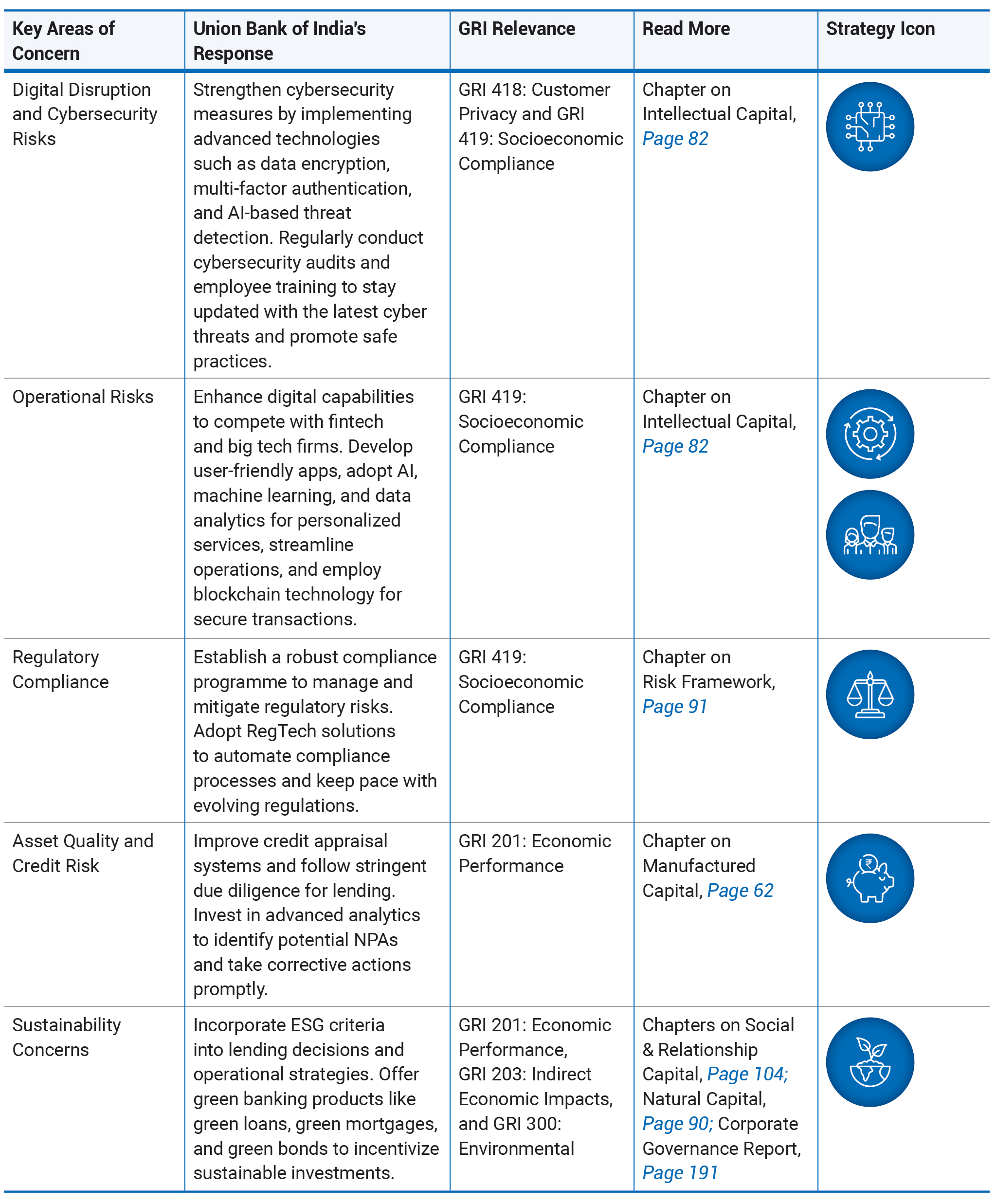

Threats, Risks and Concerns

The Indian banking sector, despite its remarkable growth trajectory and integral role in driving the nation’s economy, is confronted with a unique blend of threats, risks, and concerns, accentuated in a digitally dominant and sustainability-conscious world.

Digital Disruption and Cybersecurity Risks:

While providing significant growth opportunities, the digital revolution is a double-edged sword. There is an increased susceptibility to cyber threats, such as data breaches, phishing, and ransomware attacks. The explosion of digital banking has exponentially increased the attack surface for malefactors, causing a potential threat to the financial stability of banks.Operational Risks:

With the increased implementation of advanced technology, there’s an associated rise in operational risk due to system outages, IT failures, or breakdowns in internal procedures, people, and systems.Regulatory Compliance:

The regulatory landscape is becoming increasingly stringent, requiring banks to comply with various rules, ranging from Anti-Money Laundering (AML) laws to Know Your Customer (KYC) protocols. Non-compliance can lead to significant financial penalties and reputational damage.Asset Quality and Credit Risk:

Indian banks face a persisting issue of Non-Performing Assets (NPAs), mainly due to high corporate and agricultural sector debt. Moreover, the economic consequences of the COVID-19 pandemic have further exacerbated the credit risk situation.Sustainability Concerns:

In the face of global climate change, banks are under mounting pressure from stakeholders to transition to more sustainable operations and ensure their loan portfolios are aligned with climate-friendly projects.

Strategies for Success in a Digital World with Sustainability as a Priority

By recognizing the dynamic landscape of your Banking sector and implementing these strategies, Union Bank of India can fortify its position, optimize performance, and succeed in the digital and sustainability-conscious world. Nonetheless, this requires a delicate balance of technological adoption, regulatory understanding, prudent risk management, and a commitment to sustainability backed by a culture of innovation and adaptability. Some key strategies in play would be:

We proactively mitigate risks by advancing cybersecurity measures, improving digital capabilities, and streamlining compliance processes. Our improved credit appraisal systems safeguard asset quality, while our focus on sustainability is evident in our incorporation of ESG criteria into our operations.